How to Open a US Bank Account Online

Open a US Bank Account Online as a Non-Resident

✅ Quick Answer: Can Non-Residents Open a US Bank Account Online?

Yes! But most banks require:

✔ ITIN or SSN (Get an ITIN via W-7 form)

✔ US address (Use a friend’s or mail-forwarding service)

✔ Passport + Visa (B1/B2, H1B, L1, F1 accepted)

Fastest Options:

- Wise (Recommended) – No SSN needed

- Payoneer – Free US account number

- Bank of America – With ITIN

📌 Step-by-Step Process to Open a US Bank Account Online

1. Choose the Right Bank for Non-Residents

| Bank | Min. Deposit | SSN Needed? | Best For |

|---|---|---|---|

| Wise | $0 | ❌ No | Lowest fees |

| Payoneer | $0 | ❌ No | Freelancers |

| Bank of America | $100 | ✅ Yes (or ITIN) | Physical branches |

| Chase | $0 | ✅ Yes (or ITIN) | Credit cards |

| HSBC USA | $1,000 | ❌ No (Global Transfer) | High-net-worth |

💡 Pro Tip:

- No SSN? Use Wise or Payoneer instantly.

2. Get an ITIN (If No SSN)

- File IRS Form W-7 (With tax return)

- Submit passport copy (Certified by IRS agent)

- Wait 7+ weeks for ITIN approval

Cost: 50–200 (via certified acceptance agents).

3. Provide a US Address

Most banks require a US residential address. Options:

✅ Friend/Family Address (Best for verification)

✅ Mail Forwarding Service (e.g., Traveling Mailbox – 15/month)

✅ VirtualOffice (e.g.,Regus–50+/month)

🚫 PO Boxes don’t work!

4. Apply Online (With Required Documents)

Needed:

- Passport (Not expired)

- US Visa (B1/B2, F1, H1B, etc.)

- Proof of Address (Utility bill or bank statement)

- ITIN/SSN Letter

⏳ Processing Time:

- Wise/Payoneer: Instant

- Traditional Banks: 3–5 business days

5. Fund Your Account

- Wire Transfer (Fee: 15–50)

- Wise Transfer (Cheapest forex rates)

- Deposit Cash (If you’re in the US)

Minimum Deposit:

- Bank of America: $100

- Chase: $0

💰 Best US Bank Accounts for Non-Residents

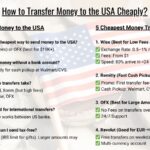

1. Wise (Best for Low Fees)

✅ No SSN needed

✅ Free US account + routing number

✅ Convert 40+ currencies

❌ No physical branches

2. Payoneer (Freelancers & Businesses)

✅ Free US bank details

✅ Accept payments from Amazon/Upwork

❌ $3/month inactivity fee

3. Bank of America (Traditional Banking)

✅ Open with ITIN

✅ Access to ATMs & credit cards

❌ 12/onthfee(Avoidablewith1,500 balance)

🚫 Common Rejection Reasons & Fixes

| Issue | Solution |

|---|---|

| No US address | Use a mail-forwarding service |

| No SSN/ITIN | Apply for ITIN or use Wise/Payoneer |

| Weak ID proof | Submit passport + visa copy |

| Bad credit history | Try digital banks first |

❓ Frequently Asked Questions

1. Can I open a US bank account on a tourist visa?

Yes! (B1/B2 works at Bank of America or HSBC).

2. Which bank does not require SSN?

Wise, Payoneer, and Mercury (for startups).

3. Can I use a virtual US phone number?

No. Most banks verify with a real US number (Google Voice doesn’t work).

4. How much does it cost to maintain the account?

- Wise: Free

- Bank of America: $12/month (waivable)

💡 Pro Tips for Non-Residents

✔ Build US credit (Get a secured credit card)

✔ Use Wise for cheap international transfers

✔ Avoid Chase/Wells Fargo without SSN