Best US Banks for International Students

Best US Banks for International Students Guide

✅ Quick Answer: Best Student Bank Accounts

| Bank | Best For | Monthly Fee | Perks |

|---|---|---|---|

| Chase College Checking | Nationwide access | $0 (for 5 years) | $100 bonus |

| Bank of America Advantage SafeBalance | No credit history | $4.95 (waivable) | No overdraft fees |

| Wise | No SSN needed | $0 | Free int’l transfers |

| Discover Cashback Debit | Online banking | $0 | 1% cashback |

🔗 Open an Account: Chase Student Banking

📌 How to Choose the Best Bank

1. Look for These Features:

✅ No/low monthly fees (Avoid accounts charging $10+)

✅ No SSN required (Some accept passport + visa)

✅ Free ATM access (Chase, Bank of America have 15,000+ ATMs)

✅ Mobile banking (Deposit checks via app)

2. Avoid These Pitfalls:

❌ High international transfer fees (Use Wise instead)

❌ Minimum balance requirements (Hard to maintain as a student)

🏦 Top 5 Banks for International Students

1. Chase College Checking

- Best for: Nationwide branch access

- Requirements: Student ID, passport, I-20

- Perks:

- $0 fees for up to 5 years

- $100 bonus for new accounts

2. Bank of America Advantage SafeBalance

- Best for: No credit history

- Requirements: Passport, US address

- Perks:

- No overdraft fees

- Waived fee for students under 24

3. Wise (Formerly TransferWise)

- Best for: No SSN + international transfers

- Requirements: Just passport

- Perks:

- Free US account + routing number

- 6x cheaper than banks for currency exchange

4. Discover Cashback Debit

- Best for: Online banking fans

- Requirements: SSN or ITIN

- Perks:

- 1% cashback on debit purchases

- 60,000+ free ATMs

5. HSBC USA

- Best for: Students from HSBC-supported countries

- Requirements: Proof of enrollment

- Perks:

- Global transfers with no fees

📝 How to Open an Account (No SSN? No Problem!)

Step 1: Gather Documents

✔ Passport

✔ Visa (F1/J1)

✔ I-20/DS-2019

✔ Proof of US address (Dorm letter or utility bill)

Step 2: Apply Online or In-Person

- No SSN? Try Wise, Bank of America, or HSBC.

- With SSN? Chase or Discover offer rewards.

Step 3: Fund Your Account

- Wire transfer from home country

- Deposit cash at a branch

💡 Pro Tips for International Students

✔ Build credit early with a secured card (e.g., Discover it® Secured)

✔ Use Zelle/Venmo for free peer-to-peer payments

✔ Avoid currency exchange fees with Wise

❓ FAQs: Student Banking in the USA

1. Can I open a bank account without an SSN?

Yes! Banks like Wise, Bank of America, and HSBC accept passports.

2. Which bank has the most ATMs?

Chase (16,000+) and Bank of America (15,000+).

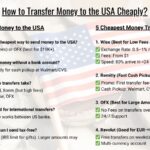

3. How do I send money home cheaply?

Use Wise or Remitly (5x cheaper than banks).

4. Can I get a credit card as a student?

Yes—start with a Discover it® Student Card (no credit history needed).

5. What’s the easiest bank to qualify for?

Wise (no SSN) or Chase College Checking (no fees for 5 years).